Register Now for Extension’s 2024 Farm Tax Webinars!

go.ncsu.edu/readext?984018

en Español / em Português

El inglés es el idioma de control de esta página. En la medida en que haya algún conflicto entre la traducción al inglés y la traducción, el inglés prevalece.

Al hacer clic en el enlace de traducción se activa un servicio de traducción gratuito para convertir la página al español. Al igual que con cualquier traducción por Internet, la conversión no es sensible al contexto y puede que no traduzca el texto en su significado original. NC State Extension no garantiza la exactitud del texto traducido. Por favor, tenga en cuenta que algunas aplicaciones y/o servicios pueden no funcionar como se espera cuando se traducen.

Português

Inglês é o idioma de controle desta página. Na medida que haja algum conflito entre o texto original em Inglês e a tradução, o Inglês prevalece.

Ao clicar no link de tradução, um serviço gratuito de tradução será ativado para converter a página para o Português. Como em qualquer tradução pela internet, a conversão não é sensivel ao contexto e pode não ocorrer a tradução para o significado orginal. O serviço de Extensão da Carolina do Norte (NC State Extension) não garante a exatidão do texto traduzido. Por favor, observe que algumas funções ou serviços podem não funcionar como esperado após a tradução.

English

English is the controlling language of this page. To the extent there is any conflict between the English text and the translation, English controls.

Clicking on the translation link activates a free translation service to convert the page to Spanish. As with any Internet translation, the conversion is not context-sensitive and may not translate the text to its original meaning. NC State Extension does not guarantee the accuracy of the translated text. Please note that some applications and/or services may not function as expected when translated.

Collapse ▲

The Chatham County Center of North Carolina Cooperative Extension is conducting a Farm Tax Webinar Series starting on February 12 and ending in early March. All webinars will be from 6–8 p.m EST. See below for details on each webinar.

Target audience: farmers (vegetables & fruits, cut flowers, livestock, hemp, row crops, etc.), nursery growers, beekeepers.

Note: this webinar series is geared towards North Carolina farmers. However, most of the information provided will be relevant to farmers throughout the U.S.

The first three webinars will be taught by Agricultural Tax Specialist Guido van der Hoeven and the final webinar will be taught by Andrew Branan, Associate Professor and Extension Legal Specialist at NC State University (see presenter bios at the bottom of this page). Guido is a retired Extension Specialist from NC State University, and we have been collaborating on farm tax workshops in Chatham County for over 12 years. These workshops always prove to be very popular; in fact, 95% of participants from our last farm tax webinar series in 2022 (close to 400 participants) said that knowledge gained from the webinars would allow them to make informed tax and business management decisions that will benefit their farm.

Examples of participant feedback from the 2022 Chatham County Farm Tax Webinar Series:

- Thank you for an amazing amount of clear, well organized, well presented information.

- I liked the way the presenter laid out the information and gave real life farm examples

- I really love the Q&A session – Guido always answers in an understandable way.

- The webinar format works great for this topic and having the webinar recordings available to re-watch later is incredibly beneficial.

- I really appreciated that the questions were answered in depth and no question was too trivial to answer.

- Great amount of information…I don’t know where else I could have gotten this, so very grateful!

- As a person slowly starting a farm business, everything was really an eye opener! The Schedule F webinars will help me create a spreadsheet to make recordkeeping much easier and more efficient. Also, I learned so much during the question and answer session!

- These webinars shed some much needed clarity and helped me organize my financial data.

- This was outstanding! I have a much better idea of the proper management of our farm regarding profits and write-offs.

Here is a list of the 2024 Farm Tax Webinars (scroll down to view details and registration links for each one):

- February 12, 2024: Farm Tax and Business Info 101

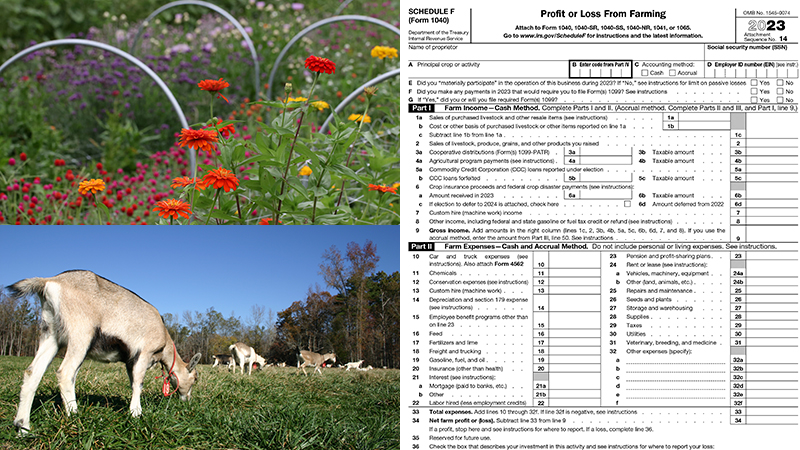

- February 19 and February 21, 2024: Schedule F Income & Expenses

- March 4, 2024: Sales Tax Issues for Farmers

You must register for each webinar separately (the two Schedule F webinars are taken together so you only register once for those).

February 12, 2024: Farm Tax and Business Info 101

Time: 6:00-8:00 p.m. EST

Presenter: Guido van der Hoeven

This first webinar is intended for new or beginner farmers and folks considering transitioning from homestead production to market farming.

Topics:

- When does the IRS consider you a farm?

- What is a Schedule F and when do I need to file one? Note: the February 19 and February 21 webinars will go into detail on the Schedule F form

- Three ways to identify yourself as a farmer

- The character of income: farm income (earned income); capital income (e.g., selling livestock, land easement, sale of stock), passive income (e.g., rental income, interest and dividends); know the difference so you know what to put on Schedule F vs. other forms

- What is a Farm Number, what is it for, and how do I get one?

- What is a Tax ID number, what is it for, where do I get one, and how is it different from a Farm Number?

- Brief introduction to sales tax: what this means for farmers, minimum income requirements, etc. (this will be covered in more detail in the March 4 webinar)

- Present Use Value Program

- Which farm business structure (sole proprietorship, LLC, etc.) is appropriate for me and when/how might that change over the years?

- What is a ”bona fide farm”?

Click here to register for the February 12 Farm Tax and Business Info 101 webinar.

The cost for the webinar is $15. Registrants will receive a recording of the webinar and a list of resources.

February 19, 2024: Schedule F Income

Time: 6:00-8:00 p.m. EST

Presenter: Guido van der Hoeven

There are two webinars covering Schedule F and they are taken as a unit. The first Schedule F webinar will be focused exclusively on income. The second webinar is two days later and covers expenses.

Topics:

- Introduction to the IRS Schedule F (Profit or Loss from Farming)

- What’s considered farm income, what’s not farm income

- Recordkeeping: what documentation/receipts you should keep; software for tracking income and expenses

February 21, 2024: Schedule F Expenses

Time: 6:00-8:00 p.m. EST

Presenter: Guido van der Hoeven

There are two webinars covering Schedule F and they are taken as a unit. The second Schedule F webinar will be focused exclusively on expenses.

Topics:

- Expenses: what’s allowed, what’s not allowed

- Depreciation and sale of business assets (e.g., dairy farmer selling a culled cow)

- Recordkeeping continued

Click here to register for the two-part Schedule F webinar.

The cost for the webinars is $30 (for both webinars). Registrants will receive a recording of the webinars and a list of resources.

March 4, 2024: Sales Tax Issues for Farmers

Time: 6:00-8:00 p.m. EST

Presenter: Andrew Branan

Topics:

- Sales tax exemption for purchase of inputs: qualifications, how to sign up, etc.

- Collection and remittance of sales taxes on sales of farm products

Click here to register for the March 4 Sales Tax webinar. This is a FREE webinar but registration is required. Registrants will receive a recording of the webinar and a list of resources.

Presenter Bios:

Guido van der Hoeven retired as an Extension Specialist/Senior Lecturer in the Department of Agricultural and Resource Economics at North Carolina State University in 2019. Guido’s Extension responsibilities included: income taxation of individuals and business entities, farm business management and the profitable continuation of “family firms” to succeeding generations. Guido van der Hoeven currently operates a consulting business, vdH Consulting, in which he is the Principal Consultant. VdH Consulting offers tax education, tax planning, business succession planning, and general rural business strategy. Van der Hoeven serves as President of the Land Grant University Tax Education Foundation, Inc. which publishes a ~650-page text for income tax training of professional tax practitioners and a ~220-page text focusing on Agricultural Taxation.

Robert Andrew Branan, JD is an Associate Extension Professor with the Agriculture and Natural Resources (ARE) Department of the College of Agricultural and Life Sciences, North Carolina State University. Andrew is a legal educator/researcher in agriculture with 20+ years experience working across North Carolina and the Southeast, including private and non-profit law practice in agricultural land use, environmental and natural resource law. His focus on farm succession, agribusiness and taxation, farmland preservation, land use regulation, water and natural resource protection, and heir property issues has placed him in speaking and community resource roles across the North Carolina. His campus courses include Environmental Law and Economic Policy and Agriculture Law. Prior to joining ARE, Andrew’s solo law practice served farmers, landowners and food entrepreneurs across North Carolina and Virginia on matters of business planning and management and asset transfer. He has authored the workbooks Planning the Future of Your Farm and So You Have Inherited a Farm, the latter focusing on co-tenancy resolution. Andrew graduated from Hampden-Sydney College in Virginia with degrees in Economics and History and earned his juris doctorate from Wake Forest University Law School. He lives with his family in Chapel Hill, North Carolina.

Questions? If you have questions about this webinar series, contact Sustainable Agriculture Agent Debbie Roos at debbie_roos@ncsu.edu.

NC State University and N.C. A&T State University commit themselves to positive action to secure equal opportunity and prohibit discrimination and harassment regardless of age, color, disability, family and marital status, genetic information, national origin, political beliefs, race, religion, sexual identity (including pregnancy), and veteran status. NC State University, N.C. A&T State University, U.S. Department of Agriculture, and local governments cooperating. Persons with disabilities and persons with limited English proficiency may request accommodations to participate by contacting Ginger Cunningham, County Extension Director, at 919-542-8202, ginger_cunningham@ncsu.edu, or in person at the Chatham County office at least 30 days prior to the event.