Hemp Production – Market Opportunities and Risks

go.ncsu.edu/readext?561442

en Español / em Português

El inglés es el idioma de control de esta página. En la medida en que haya algún conflicto entre la traducción al inglés y la traducción, el inglés prevalece.

Al hacer clic en el enlace de traducción se activa un servicio de traducción gratuito para convertir la página al español. Al igual que con cualquier traducción por Internet, la conversión no es sensible al contexto y puede que no traduzca el texto en su significado original. NC State Extension no garantiza la exactitud del texto traducido. Por favor, tenga en cuenta que algunas aplicaciones y/o servicios pueden no funcionar como se espera cuando se traducen.

Português

Inglês é o idioma de controle desta página. Na medida que haja algum conflito entre o texto original em Inglês e a tradução, o Inglês prevalece.

Ao clicar no link de tradução, um serviço gratuito de tradução será ativado para converter a página para o Português. Como em qualquer tradução pela internet, a conversão não é sensivel ao contexto e pode não ocorrer a tradução para o significado orginal. O serviço de Extensão da Carolina do Norte (NC State Extension) não garante a exatidão do texto traduzido. Por favor, observe que algumas funções ou serviços podem não funcionar como esperado após a tradução.

English

English is the controlling language of this page. To the extent there is any conflict between the English text and the translation, English controls.

Clicking on the translation link activates a free translation service to convert the page to Spanish. As with any Internet translation, the conversion is not context-sensitive and may not translate the text to its original meaning. NC State Extension does not guarantee the accuracy of the translated text. Please note that some applications and/or services may not function as expected when translated.

Collapse ▲Hemp Production in North Carolina is new and changing rapidly. There is a massive shortage of research-based info regarding the basic agronomic recommendations but we are making progress. Because of the great interest in hemp from our farmers, industry, community leaders, and potential consumers of hemp products I will summarize what I have learned from listening to numerous people working with this crop.

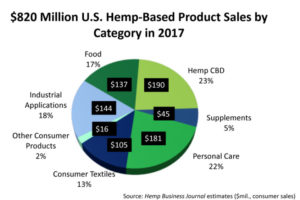

Industrial hemp markets are growing. In 2015, the US hemp-based product sales totaled $573 million. In 2016, sales grew to $688 million and in 2017 sales reached $820 million. Those sales include food products, industrial applications, fiber products as well as products from the CBD oil. The majority of hemp producers in NC are interested in the CBD oil market.

I have spoken with a few processors in NC regarding how they are working with farmers in pricing and acceptance conditions.

MVP Enterprises is a processor in Iredell County that is accepting wet hemp flower biomass (within 48 hours of harvest). Their pricing is based on total CBD content. Because MVP is processing the whole plant (stems included) they had many samples testing at 3% CBD. The flower may have CBD levels at 10% or higher but the very low CDB percent in the stem brings the overall CBD percent of the sample down.

Sugarleaf Labs is a processor in Catawba County. They like to receive dried (below 10% moisture) flower biomass without stems. However, they will accept fresh cut biomass with stems on.

Prices vary with the market and how the processor will accept the biomass. Here are a few scenarios described to me by processors that I will not specify (the market changes quickly so no one wants to be pigeonholed with a pricing) in October of 2018,

With one processor, for wet weight plants from $3.00 to $3.65 is paid per CBD percentage. If a farmer delivers one plant that weighs 4 lbs (wet weight including stems), that would fetch about $36 to $43 for one plant [($3.00 to $3.65 per CBD%) x (3% CBD) x (4 lbs)]. In this scenario, there was not a price premium discussed for a level of contaminants or spectrum of other cannabinoids or terpenes. If this farmer produced 2000 lbs of similar wet weight floral material in an acre they could gross $18,000 to $21,900 per acre.

A different processor described a scenario for the purchase of dried floral material without stems. Depending on the quality (cannabinoid spectrum, impurities, mold) of the material they would pay anywhere from $2 to $7 per percentage of CBD. If a farmer produced 1000 lbs of biomass (dried and stemless), with a CBD percentage of 10% and the highest quality cannabinoid spectrum with no contamination or impurities they could gross $70,000 per acre [($7) x (10% CBD) x (1000 lbs biomass)]. However, if that farmer produced that same biomass but with 5% CBD and lowest quality of cannabinoids and impurities that farmer could gross $10,000 per acre [($2) x (5% CBD) x (1000 lbs biomass)].

There are significant risks with growing hemp for CBD. If the markets get saturated prices could drop quickly. Production costs are estimated at $13,000 to $15,000 per acre primarily due to the high cost of female clone plants ($5 to $10 per plant with 1200 to 1500 plants per acre). I advise all farmers to start small and begin talking with processors right away. Know your market before you plant the crop! Speaking of risk, did I mention that the farmer loses everything if the THC of their plant goes higher that 0.3% at anytime? Read this article:

- Hemp Production – Keeping THC Levels Low

- Hemp Production – Market Opportunities and Risk

- Harvesting and Drying Hemp Biomass For CBD

- Hemp Production in Catawba County

- Industrial Hemp Pest Management

The information regarding hemp is changing quickly so keep visiting these resources and stay tuned.